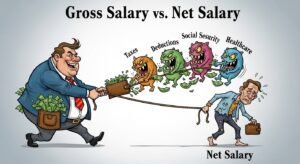

Entering the workforce or negotiating a new job offer often brings a flurry of financial terminology that can leave even seasoned professionals feeling confused. At the center of this confusion is the fundamental distinction between the number on your contract and the number in your bank account. Understanding gross salary vs net salary is not just about knowing your worth; it is about accurate budgeting, tax compliance, and long-term financial health.

For most employees, the “sticker price” of a job offer is the gross amount, but the reality of daily life is funded by the net amount. Failing to grasp the mechanics of gross salary vs net salary can lead to significant financial surprises, especially during tax season. In this comprehensive guide, we will break down the components of each, examine the common deductions that sit between them, and provide the clarity you need to master your personal compensation.

1. What is Gross Salary?

Gross salary represents the total amount of money an employer pays an employee before any taxes, mandatory contributions, or voluntary deductions are removed. It is the comprehensive “top-line” figure typically used in employment contracts, recruitment advertisements, and loan applications.

Components of Gross Salary

When you look at gross vs net salary comparisons, the gross figure is composed of several elements beyond just your base pay:

- Base Pay: The core hourly or annual rate agreed upon.

- Overtime: Additional pay for hours worked beyond the standard workweek.

- Bonuses: Performance-related or signing bonuses.

- Commission: Variable pay based on sales or targets.

- Allowances: Stipends for travel, housing, or specialized equipment.

The gross figure is the starting point for all payroll calculations. However, it is rarely the amount you actually get to spend, which is why the debate of gross salary vs net salary is so vital for every worker to understand.

2. What is Net Salary?

Net salary, commonly referred to as “take-home pay,” is the amount of money an employee receives after all deductions have been subtracted from the gross total. This is the “bottom-line” figure that actually enters your bank account on payday.

The Reality of Net Salary

Understanding your net pay is essential because it dictates your actual purchasing power. When using a net vs gross salary calculator, the net figure is the result of the gross pay minus:

- Federal and State Income Taxes: The government’s share of your earnings.

- Social Security and Medicare: Mandatory contributions for national insurance or retirement schemes.

- Insurance Premiums: Your portion of health, dental, or life insurance.

- Retirement Contributions: Voluntary or mandatory savings for the future.

While the gross pay is what you “earn,” the net pay is what you “keep.” This distinction is the bedrock of gross salary vs net salary literacy.

3. Side-by-Side Comparison: Gross vs Net

Visualizing net salary vs gross salary differences helps in identifying where your money goes. While gross vs net salary figures are related, they serve very different purposes in your financial life.

| Feature | Gross Salary | Net Salary |

| Definition | Total pay before any deductions | Total pay after all deductions |

| Usage | Job offers, loan applications, tax brackets | Monthly budgeting, bill payments, savings |

| Volatility | Usually fixed (unless hourly) | Can change based on tax law or benefit choices |

| Who Sees It? | HR, Banks, Government | The Employee |

| Primary Goal | Competitive market positioning | Real-world purchasing power |

Choosing to focus on net vs gross salary depends on the context. If you are applying for a mortgage, the lender looks at the gross; if you are buying groceries, you look at the net.

4. Common Deductions Affecting Your Pay

To bridge the gap between gross salary vs net salary, one must understand the “leakage” that occurs through deductions. These are generally categorized into three main buckets.

Statutory Deductions (Mandatory)

These are required by law. In most countries, this includes income tax and social insurance. When calculating gross salary vs net salary, these are the non-negotiable subtractions. In the United States, this includes FICA taxes (Social Security and Medicare).

Benefit Deductions (Voluntary)

Modern compensation packages often include benefits that require employee contributions. This includes premiums for health insurance or vision plans. These deductions are subtracted from your gross pay, directly impacting the net vs gross salary outcome.

Retirement and Savings

If you contribute to a 401(k), IRA, or pension scheme, these funds are usually taken directly from your gross pay. While this lowers your current net pay, it builds your future wealth, a nuance often missed in a basic net vs gross salary calculator session.

5. Gross vs Net Salary Around the World

The percentage of your gross pay that becomes net pay varies wildly depending on where you live. This is why gross salary vs net salary understanding is critical for digital nomads and international professionals.

- United States: Depending on the state, an employee might keep 65% to 75% of their gross pay.

- United Kingdom: With National Insurance and tiered income tax, the net salary vs gross salary ratio often settles around 70% to 80% for average earners.

- Germany and Belgium: These countries often have higher tax rates for social services, meaning the gross salary vs net salary gap can be as high as 45%.

Always research the local tax climate before accepting an international offer based solely on the gross figure.

6. How to Calculate Net Salary (Step-by-Step)

If you want to move beyond a net vs gross salary calculator and understand the math yourself, follow these steps:

- Identify Total Gross Pay: Sum up your base pay, bonuses, and overtime for the period.

- Determine Taxable Income: Subtract any “pre-tax” deductions (like 401k contributions in the US) from your gross pay.

- Calculate Income Tax: Apply the relevant tax brackets to your taxable income.

- Subtract Mandatory Insurance: Calculate Social Security, Medicare, or National Insurance based on your country’s rates.

- Remove Post-Tax Deductions: Subtract things like health insurance premiums or union dues.

- Final Result: The remaining figure is your net pay.

Repeating this process monthly helps you verify the accuracy of your employer’s payroll department and deepens your understanding of gross salary vs net salary dynamics.

7. Common Salary Calculation Mistakes

Even HR professionals can make mistakes, but most errors come from employees misinterpreting their gross salary vs net salary data.

- Underestimating Tax Brackets: Many assume a 20% tax rate means 20% of their total pay. In reality, progressive tax systems mean only a portion is taxed at that rate.

- Forgetting One-Time Deductions: Things like professional fees or uniform costs can occasionally appear, temporarily lowering your net pay.

- Miscalculating Bonuses: Bonuses are often taxed at a higher “supplemental” rate initially, which can skew your gross salary vs net salary expectations for that month.

- Ignoring Exemptions: Failing to claim the correct tax exemptions can lead to an unnecessarily low net salary throughout the year.

8. Negotiating Job Offers: Gross vs Net

When you receive an offer, the company will always quote the gross. However, savvy negotiators always keep the gross salary vs net salary shift in mind.

Focus on Gross for Negotiation

Always negotiate based on the gross salary. This is the industry standard and ensures you are being compared fairly to other candidates. If you focus too much on net vs gross salary during the interview, you might confuse the recruiter, as they don’t know your personal tax situation (e.g., your spouse’s income or your mortgage interest).

Focus on Net for Lifestyle

Once the gross is agreed upon, use a net vs gross salary calculator to see if that amount supports your cost of living. If the net pay is too low for your city’s rent and expenses, you may need to ask for a higher gross or additional non-taxable benefits like a housing stipend.

9. Actionable Tips to Increase Take-Home Pay

While you can’t usually change your tax brackets, you can optimize your gross salary vs net salary ratio legally:

- Utilize Pre-Tax Accounts: Contributions to HSAs or retirement accounts lower your taxable income, meaning the government takes less of your gross.

- Check Your Withholding: Ensure you aren’t overpaying taxes throughout the year just to get a large refund later. A balanced net vs gross salary approach keeps more money in your pocket monthly.

- Tax-Free Benefits: Negotiate for benefits that don’t add to your taxable gross, such as gym memberships, tuition reimbursement, or transit passes.

- Relocation: If you work remotely, moving to a state or country with lower income tax can significantly improve your gross salary vs net salary outcome.

10. Conclusion: Smarter Salary Understanding

Mastering the concept of gross salary vs net salary is a prerequisite for financial success in the modern world. By distinguishing between what you earn on paper and what you receive in your account, you can build more accurate budgets, negotiate better contracts, and avoid the stress of unexpected tax bills.

Remember that while the gross pay defines your professional standing, the net pay defines your daily reality. Use a reliable net vs gross salary calculator regularly to stay updated on your earnings, and don’t be afraid to ask your HR department for a detailed breakdown if the numbers don’t seem to add up. With a clear view of gross salary vs net salary, you are no longer just an employee—you are a financially literate professional in control of your future.

Frequently Asked Questions

Why is my net salary so much lower than my gross?

This is due to the cumulative effect of income taxes, social security contributions, and benefit premiums. A detailed gross salary vs net salary analysis usually reveals that taxes are the largest contributor to this gap.

Should I use a net vs gross salary calculator for every paycheck?

It is a good habit. Checking your gross salary vs net salary monthly ensures that any changes in tax law or company benefits are being applied correctly to your pay.

Is gross salary always higher than net salary?

Yes. Since net salary is calculated by subtracting deductions from the gross, it is mathematically impossible for the net to be higher than the gross in a standard employment scenario. Understanding gross salary vs net salary means accepting that a portion of your earnings will always go toward taxes and benefits.